Renewing your car insurance policy eight days before it expires could save you money. That’s according to data released by a leading price comparison website.

It found that drivers who renewed with eight days to go saw an average saving of £132 (28 percent). This is in comparison to if they had taken the price quoted on the day the policy was due to start.

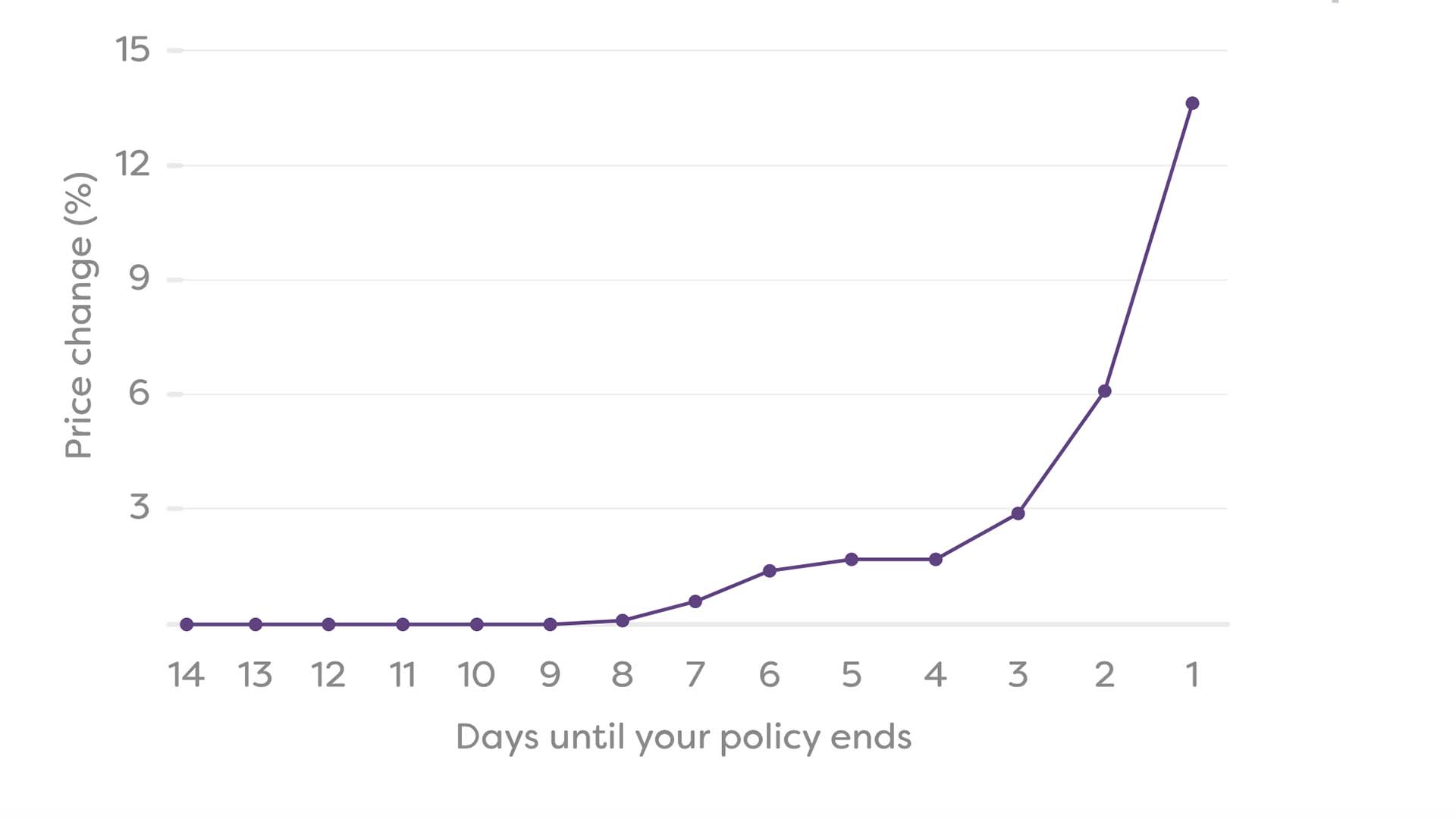

The data shows that prices start to rise three days before a policy’s expiry. The most expensive policies are those bought on their current policy’s end date.

This graph shows the difference a little forward planning can make.

MoneySuperMarket is keen to point out that there’s no extra benefit to renewing your policy more than eight days ahead of schedule. Any longer than that and the curve is flat.

Being organised is the key. You should receive a renewal notification a month before the policy is up for renewal. Place the renewal documents in a visible location to serve as a reminder to search for some cheaper quotes. Never accept the renewal quote offered by your existing provider.

Figures provided by MoneySuperMarket show that car insurance auto-renewal costs motorists an estimated £565 million every year. Insurers add an average of £40 per year to existing policies. At the very least, give your current provider a call to see if they can reduce the quote.

Finding alternative prices in advance is a good idea. A price comparison website is a good place to start, but it’s worth remembering that some of the best insurance companies aren’t listed on such sites.

‘Shop around’

Rachel Wait, consumer affairs spokesperson at MoneySuperMarket, said: “If there’s one thing to remember when it comes to saving money on your car insurance, it’s making sure you shop around before your policy automatically renews – you could save hundreds of pounds.

“What our data shows is that the time you run your quotation can also have an important bearing on the level of savings you can make. Insurers know that many of us leave buying insurance to the last minute, which is why we see prices increasing closer to the date a policy is due to expire. To avoid higher costs, you should shop around for your new policy at least a week before the old one runs out and lock in the price you are offered at that point – those that do can make substantial savings.”