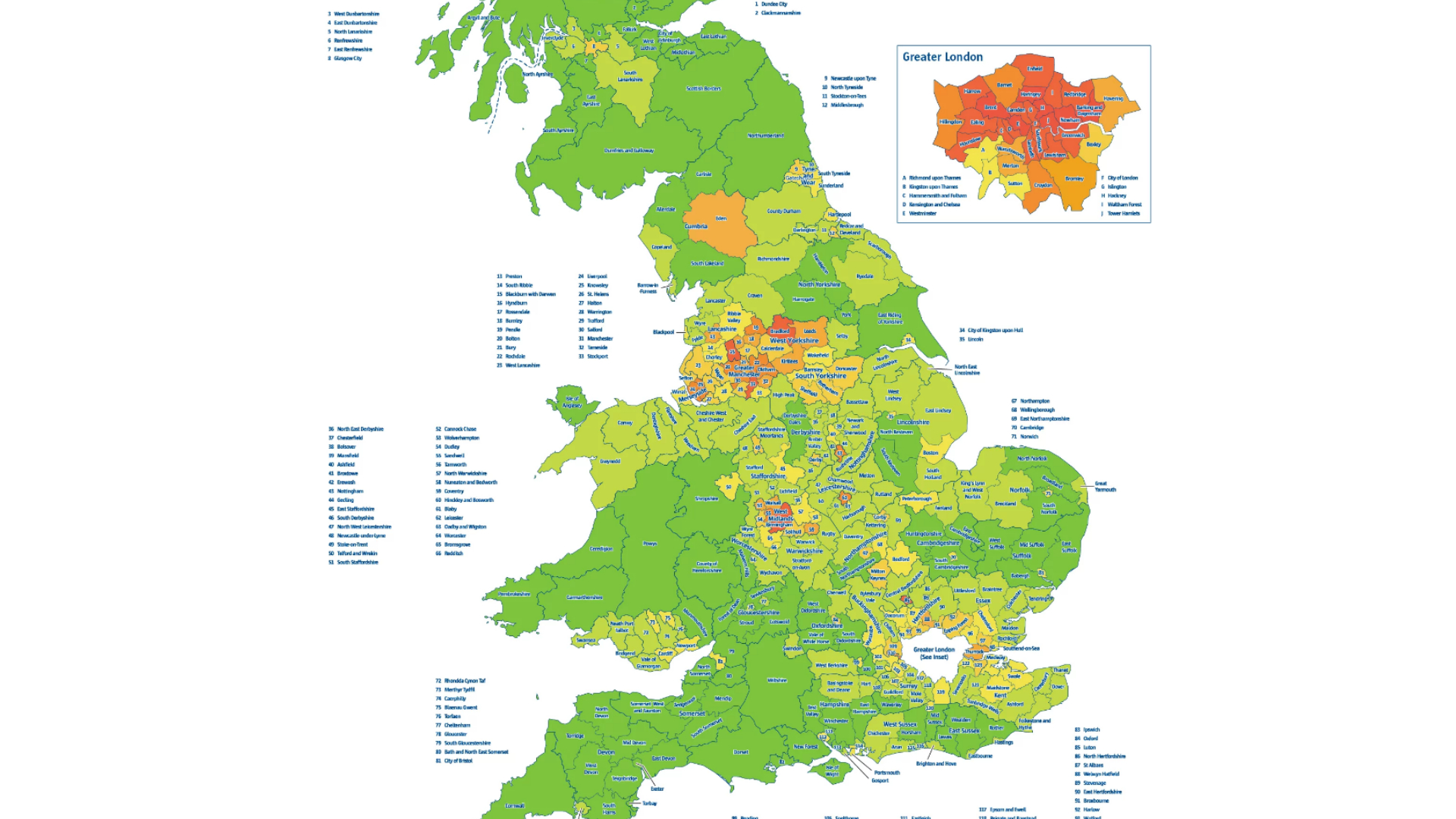

Many factors come into play when it comes to car insurance, including where you live. Indeed, your postcode could have the biggest impact on your quote.

An insurer will have data on your area, including accident, damage and car theft figures. If you’re in a hotspot, you can expect a steep premium.

Here are the best places in the UK for car insurance, as compiled by CompareTheMarket.

The 10 cheapest areas for car insurance

By and large, it’s England’s south west that wins the battle for cheap insurance. The average yearly premium for five of the local authorities in this area is £490.

Bar Scotland and Norfolk, the top 10 cheapest places to insure your car are exclusively south-western.

- Caradon (Cornwall)

- West Devon

- South Hams (Devon)

- East Devon

- West Somerset

- North Devon

- North Norfolk

- Teignbridge (Devon)

- Scottish Borders

- Stroud

As for where is the most expensive? It’s probably not surprising that London dominates here. The London’ borough of Newham has the highest typical premium, at a massive £1,464.

However, not counting the capital, Manchester (£1,260) and Birmingham (£1,173) are up there, along with Luton (£1,165). The former two are the next biggest cities after London. Generally speaking, proximity to these areas doesn’t help your chances of cheap insurance, as you can see on the above map.

“It’s common knowledge that the age and value are key variables in determining car insurance quotes, but location also plays a major role,” said Dan Hutson, head of motor at CompareTheMarket.

“The right policy for one person may be different for a friend or family member down the road, even if they live on the same street. Our research reveals that shopping around three weeks ahead of time is usually the cheapest way to buy or renew your car insurance.”