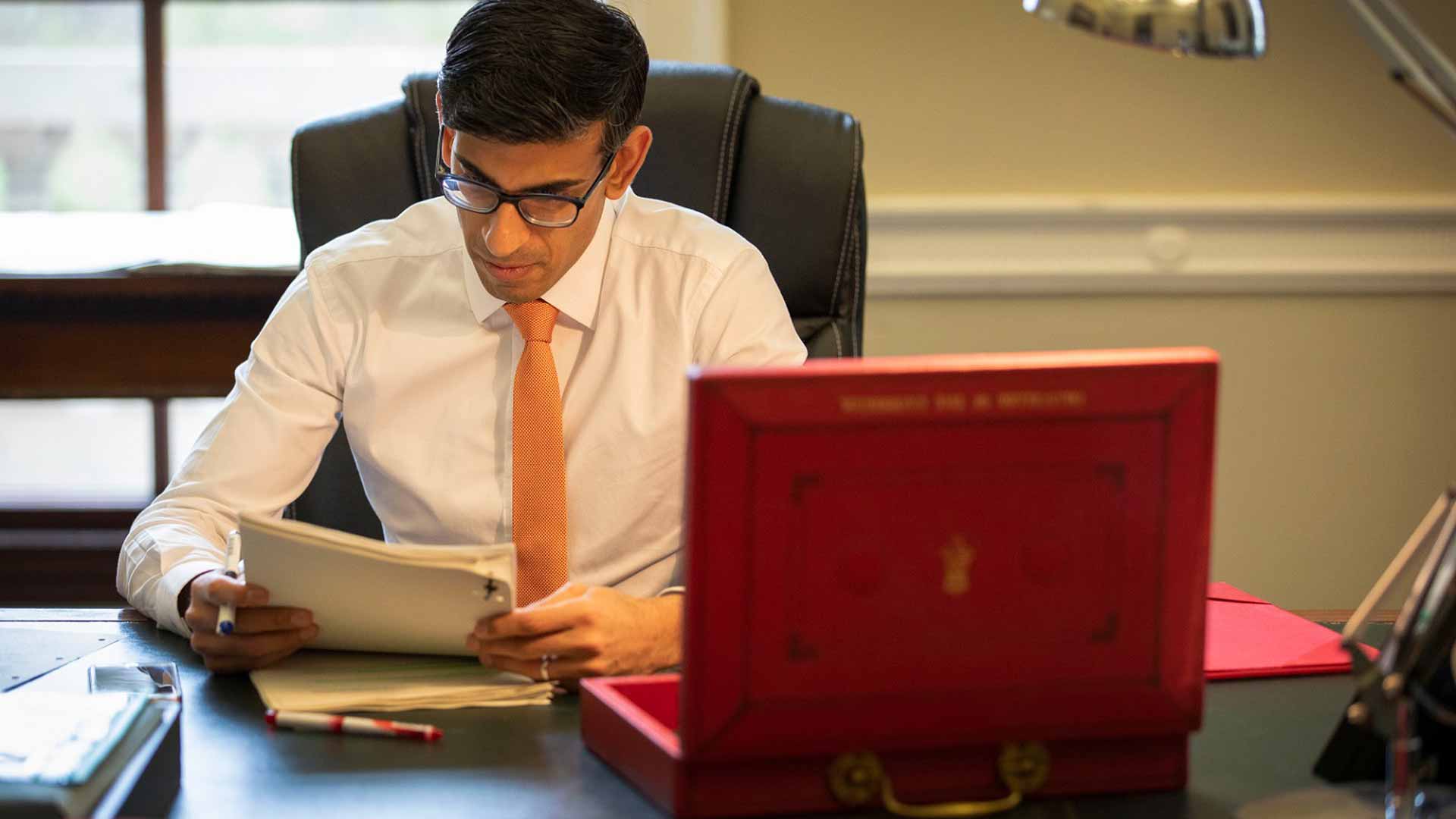

Chancellor Rishi Sunak has delivered his first Budget, which he said is “about delivering our promises”. But what does the 2020 Budget mean for motorists?

Early in his statement, Sunak admitted that “many people still rely on their cars”, before announcing details of changes to the country’s transport and infrastructure. Here are the motoring headlines and how they could impact you.

Plug-in Car Grant

Relief for the industry – the government will provide £403 million for the Plug-in Car Grant, extending the scheme to 2022-2023. A further £129.5 million will be provided to extend the grant for vans, taxis and motorcycles.

However… the grant itself has been CUT, from £3,500 to £3,000. This reduction is effective for all orders placed after 11:59pm on 11 March (i.e. immediately). Cars costing £50,000 or more will also be ineligible for the grant.

It will “allow more drivers to benefit from making the switch for longer” argues the government.

This is a significant change and we will bring you the industry’s response below as we get it.

Fuel duty

Fuel duty will remain the same for the next year. The Chancellor said the freeze on fuel duty has saved the average car driver £1,200 since 2010. Future fuel duty rates are being considered, alongside measures required to help meet the country’s ‘net zero’ emissions commitment.

Electric car chargers

A total of £500 million is being allocated to the roll-out of rapid electric car charging hubs. The government says that nobody should be more than 30 miles from a rapid charger.

Electric vehicles

The government will invest more than £900 million to “ensure UK businesses are leading the way in high-potential technologies.”

A portion of this funding contributes to an investment of up to £1 billion to develop UK supply chains for the large-scale production of electric vehicles, as announced in September 2019.

Other consumer incentives to support the transition to zero emissions are being considered. The Budget confirmed the planned phase-out date for the sale of new petrol and diesel cars and vans from 2040, but reiterated that this could be brought forward.

Potholes

The government has created a £2.5 billion pothole fund to be spent over the next five years. It says it’s enough to tackle 50 million potholes by the end of parliament.

VED

Exemption of Vehicle Excise Duty, or road tax, for zero emission electric vehicles will continue. What’s more, they are also now exempt from the ‘expensive car’ first-year supplement for vehicles costing over £40,000.

However, for the next tax year, the price of road tax will be uprated in line with inflation, adding a few pounds to the cost.

Strategic roads

Sunak announced the largest ever investment in English strategic roads, with the government promising to spend £27 billion between 2020 and 2025. Projects include:

- Dualling the A66 Trans-Pennine route

- Upgrading the A46 Newark bypass

- Addressing congestion on key routes in the North East and the Midlands

- Improving the M60 Simister Island in Manchester

- Building the Lower Thames Crossing

- Building a new dual carriageway and two-mile tunnel on the A303 at Stonehenge

- Exploring how to connect communities in East Lancashire and West Yorkshire

- Considering improvements to the A1 north of Newcastle and in Yorkshire

- Investigating a potential link between the M4 and the Dorset coast

Local roads

In addition to the improvements announced for the strategic road network, the government has also committed to a number of local road upgrades. These include the A39 in Cornwall, the A12 east of Ipswich, the refurbishment of Kew Bridge and improving the A350 at junction 17 of the M4.

Company car taxes

Previously-announced company car taxes for the next five years were confirmed. The rate on electric cars falls from 16 percent to ZERO percent for the next tax year. It then rises by one percent for the subsequent two years, and is then frozen at 2 percent for a further two years.

Experts say this could save company car drivers who choose an EV a staggering 95 percent in company car tax, compared to an alternative diesel car.

Red diesel

The government will remove entitlement to the use of red diesel and rebated biofuels from April 2022, except for agriculture, horticulture, pisciculture, forestry, rail and for non-commercial heating.

In his statement, Sunak said that some users of red diesel are contributing to pollution and the current tax break has been harmful to the environment.

2020 Budget: the reaction

RAC head of policy Nicholas Lyes said: “We welcome the Chancellor’s freeze in fuel duty, which will be a relief to drivers up and down the country… while the Chancellor might have been tempted to increase duty, the reality is that for millions this would have simply increased their everyday driving costs and done nothing to encourage them to switch to cleaner vehicles.”

AA president Edmund King welcomed the Budget, tweeting: “Putting more money into potholes; freezing fuel duty; improving roads such as the A303 and A1; and spending £500m on electric vehicle charging, will all contribute to keep Britain moving in the years ahead.”

Auto Trader director Ian Plummer said that “interest in pure electric vehicles is growing apace… improving the charging infrastructure has the propensity to increase adoption in the longer-term, as consumers will be able to see how electric vehicles could viably fit into their lifestyles. However, [they] will take time to implement and won’t alleviate current fears… we aren’t expecting any vast changes in EV adoption this year off the back of today’s announcement”.

SMMT chief executive Mike Hawes, said: “We are pleased to see the Chancellor find room in his Budget to help make zero emission motoring a more viable option for more drivers. The continuation of a plug-in car grant is an essential step in the right direction and, alongside the removal of the premium car surcharge on VED and reduction in company car tax, as well as a strategic review of national charging infrastructure requirements, should help encourage consumers and support the beginnings of a market transition.